State of corporate governance

We have prioritized the improvement of corporate value as one of our most important tasks for all our shareholders and investors, and are working hard to adopt various measures for perfecting corporate governance that will strengthen our monitoring and supervision functions, etc., in order to facilitate expediting of management decision-making and action-taking, securing transparency and fairness, and realizing thoroughgoing compliance.

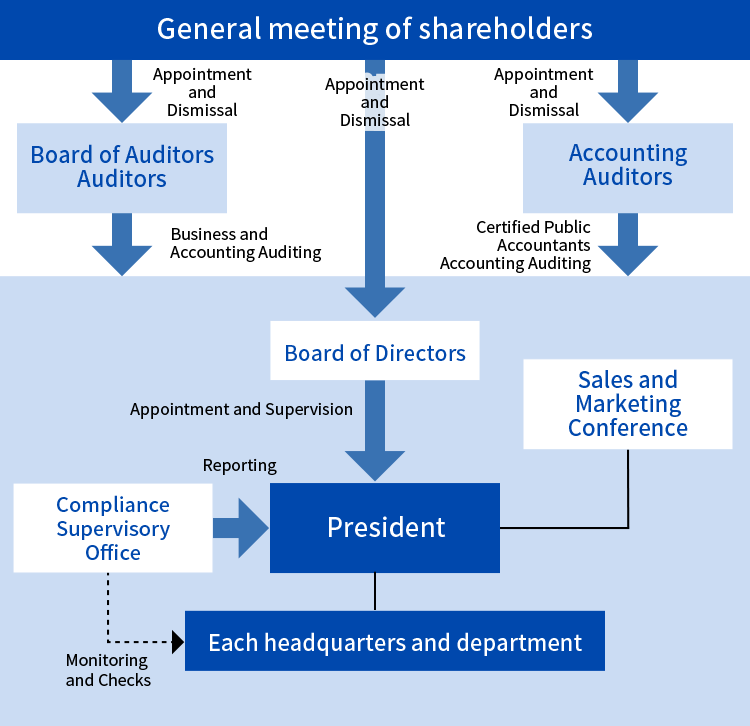

1. System of corporate governance

(1) Overview of our system of governance

Our company has established a Board of Auditors. We have adopted our present system based on our belief that facilitating mutual collaboration between independent directors (including independent directors), the Board of Auditors, and our Internal Audit Department and strengthening managerial oversight are key to making excellent management a reality and securing the confidence of all our shareholders and investors. We have established the following councils as a system for making decisions concerning the conducting of corporate affairs and for managerial oversight.

Board of Directors

Ten directors and four auditors attend meetings of the Board of Directors, which are held once every month. These meetings are chaired by President Kazuo Takamisawa. At these meetings, decisions are made regarding supervision of the state of corporate affairs and important issues with management.

Board of Auditors

Four auditors attend meetings of the Board of Directors, which are held once every month. These meetings are chaired by Standing Statutory Auditor Akinori Oi. At these meetings, auditors closely share information and work to strengthen managerial oversight functions. Auditors also attend meetings of the Board of Directors and meetings of management, and have established a system that enables sufficient observation of managers as they conduct corporate business.

Sales and Marketing Conference

Meetings of management are attended by a total of 29 individuals including internal directors, standing statutory auditors, division/office/center chiefs from our various businesses, and CEOs from our group’s companies. These are held once every month. These meetings are chaired by Managing Director Hidekuni Tsujikawa. At these meetings, reports are given and proposals are made from each department, before deciding how corporate affairs will be managed.

(2) State of establishment of internal regulatory and risk management systems

In order to facilitate internal regulation of our corporate affairs in general, we have established a Compliance Supervisory Office reporting directly to the President; implemented internal auditing of the suitability, efficacy, and extent of execution of basic business plans in each division, their states of progress and compliance, etc., while providing specific advice and recommendations for business operations.

Also, to facilitate internal regulation of financial reporting, we have organized an “Internal Regulatory Promotion Project” in which representatives from each department participate. This project promotes application of internal regulations as well as verifications and evaluations.

(3) Overview of content of limitation of liability agreement

Our company and its directors (excluding individuals who are managing directors, etc.) and auditors have entered into an agreement to limit liability for indemnification for damages under Article 423 Paragraph 1 of the Companies Act pursuant to the stipulations of Article 427 Paragraph 1 of said law. The maximum amount of liability for reparations for damages pursuant to the agreement in question is the amount established by laws and ordinances for both auditors and directors. These limitations of liability are only applicable when the duties by the directors and auditors in question from which liability arises are executed in good faith and without gross negligence.

2. State of internal auditing and auditing by auditors

Four individuals sit on our Board or Auditors. Half (i.e. two) of these are outside auditors, who ensure transparency and oversee managerial monitoring and auditing functions. The outside auditors also ensure that auditing is conducted independently of our company.

During auditing by these auditors, they closely collaborate with the Compliance Supervisory Office run by three internal auditors to gain a constant and comprehensive understanding of information provided by the internal auditors.

Additionally, in order to ensure the appropriateness of accounting auditing, the auditors work to bolster collaboration with accounting auditors through such measures as periodically receiving necessary reports through interim and end-of-term auditing by the accounting auditors. They also receive reports concerning the state of the “Internal Regulatory Promotion Project” as appropriate.

Outside auditors Tamio Kurata and Masaru Tanaka both have experience with settlement procedures and financial statements during their work with the Accounting Department of Fuji Electric Co., Ltd., and are suitably knowledgeable about finances and accounting.

3. State of accounting auditing

We have entered into an auditing agreement with Ernst & Young ShinNihon LLC, who act as our accounting auditors and provide us with accounting auditing services. The following individuals are certified public accountants who have carried out our company’s accounting auditing work.

– Masahiro Ito, Designated Limited Liability Partner, Active Partner

– Kenji Fujita, Designated Limited Liability Partner, Active Partner

Seven certified public accountants and an additional 18 individuals are also involved in our company’s accounting auditing work.

4. Outside directors and outside auditors

(1) Outside directors

There are two outside directors working with our company.

External Director Hideaki Matsuura is the Production Supervisory Division Chief at the Food Distribution Business Headquarters of Fuji Electric Co., Ltd. Fuji Electric Co., Ltd. is a major shareholder in our company (with a stake of 25.87%) and has regular business transactions with us. Also, Outside Auditor Atsunori Kimura is Managing Executive Officer at Fujitsu Frontech, Ltd. Said company is a large shareholder in our company (with a stake of 5.68%) and has regular business transactions with our company through its parent company, Fujitsu Limited. Neither outside auditor has any conflicts of interest in working with our company.

Both outside auditors attend meetings of the Board of Directors and make statements grounded in their comprehensive experience and wide-ranging knowledge concerning our company’s business areas. We recognize that this helps to strengthen managerial oversight functions and improve the efficacy of internal regulations.

We have no established criteria or policies concerning independence when appointing outside directors and outside auditors. However, when making such appointments, we do refer to the acceptance criteria stipulated in the “Guidelines for Listing Management” established by the Tokyo Stock Exchange as one condition for appointing candidates. This company has designated Atsunori Kimura as an independent auditor per the stipulations of the Tokyo Stock Exchange, which has been notified of his appointment.

(2) Outside auditors

There are two outside auditors working with our company.

Outside Auditor Tamio Kurata is a former standing statutory auditor at Fuji Electric Retail Systems Co., Ltd. (now Fuji Electric Co., Ltd.) Outside Auditor Masaru Tanaka is Business Planning Division Chief at the Business Supervisory Division in the Food Distribution Business Headquarters of Fuji Electric Co., Ltd. This firm is a major shareholder in our company (with a stake of 25.87%) and conducts regular business transactions with us. Neither outside auditor has any conflicts of interest in working with our company.

We have secured the independence of both auditors, and have designated Tamio Kurata as an independent auditor per the stipulations of the Tokyo Stock Exchange, which has been notified of his appointment.

These outside auditors also attend meetings of the Board of Directors, ascertain the state of conducting of corporate affairs, and conduct monitoring. Additionally, they also provide suitable proposals and advice when appropriate. The outside auditors also attend meetings of the Board of Auditors, and closely exchange information with the auditors on the board in order to strengthen managerial oversight functions.

5. Executive compensation, etc.

(1) Total amounts of compensation, etc., for each subdivision of executives, total amounts by type of compensation, etc., and number of executives compensated

Executive compensation for our directors and auditors this term as detailed below.

| Executive subdivision | Total amount of compensation, etc. (thousands of JPY) | Total amount of compensation, etc., by type (thousands of JPY) | Number of executives compensated (individuals) | |||

|---|---|---|---|---|---|---|

| Base compensation | Stock options | Bonus | Retirement bonus | |||

| Directors (excluding outside directors) | 76,297 | 76,297 | ― | ― | ― | 9 |

| Auditors (excluding outside auditors) | 16,644 | 16,644 | ― | ― | ― | 2 |

| Outside directors | 1,920 | 1,920 | ― | ― | ― | 7 |

Notices:

1. The above include amounts of compensation, etc., during the tenures of three directors (of these, two were outside directors) and one auditor (an outside auditor) who retired at the conclusion of the 49th regular general meeting of shareholders held on June 28, 2018.

2. Allowances for work performed as employees provided to directors serving dual roles as employees are not included in the allowances to directors.

3. The auditor and director retirement bonus system was abolished at the conclusion of the 44th regular general meeting of shareholders held on June 27, 2013. Even after the conclusion of said general meeting of shareholders, we have decided to provide executive retirement bonuses to retiring directors and auditors upon retirement in amounts corresponding to their periods of employment up through the abolition of the executive retirement bonus system. Pursuant to the preceding, we have paid an executive retirement bonus of ¥13,928,000 to one executive who retired during this fiscal year. Also, the fixed amount expected to be paid to six current executives that will later be discontinued due to the abolition of the executive retirement bonus system at the end of this fiscal year is ¥70,077,000. These amounts include the provision amount for executive retirement bonus reserve funds disclosed in business reports for past fiscal years.

(2) Details and means of determining policies concerning amounts of compensation, etc., for executives and the methods by which they are calculated.

We have no established policies related to executive compensation amounts or determining their calculation methods.

6. State of stock ownership

(1) Criteria and approaches for investment stock subdivisions

Our approach toward criteria for subdividing investment stocks into those held for net investment purposes and those held for other purposes is as follows.

- “Investment stock held for purposes other than net investment” refers to shares in business partners of our company’s group for which it was determined that ownership by our company would allow for strengthening of long-term and stable relationships between our company and said partners.

- “Investment stock held for net investment purposes” refers to all stock for which our approach to “investment stock held for purposes other than net investment” does not apply.

(2) Investment stock held for purposes other than net investment

(i) Methods for verifying ownership policies and reasonableness of ownership, and details of verification during meetings of the Board of Directors concerning appropriateness of owning individual stock

We have established policies for owning shares in partners of our company’s group for which we have determined that ownership by our company would allow for strengthening of long-term and stable relationships between our company and said partners. Our Board of Directors verifies whether each individual stock we own would contribute to our group’s sustainable growth and improved corporate value from a long-term perspective.

(ii) Number of stocks and total amounts calculated in balance sheets

| Number of stocks (individual issuers of shares) | Total amounts calculated in balance sheets (thousands of JPY) | |

|---|---|---|

| Unlisted stocks | 3 | 17,940 |

| Stocks other than unlisted stocks | 11 | 390,774 |

| Number of stocks (individual issuers of shares) | Total acquisition price for the increase in the number of shares (thousands of JPY) | Reason for the increase in the number of shares | |

|---|---|---|---|

| Unlisted stocks | ― | ― | ― |

| Stocks other than unlisted stocks | 3 | 3,616 | Purchases by the shareholder’s association |

(Issuers of shares for which the number of shares have decreased this fiscal year)

No applicable items

(v) Information concerning numbers of shares for each issuer of shares owned by our company and deemed-owned shares, amounts calculated in balance sheets, etc.

| Issuer | Current fiscal year | Previous fiscal year | Ownership objectives, quantitative ownership effects, and reasons for increasing the number of shares | Ownership in our company’s stock | ||

|---|---|---|---|---|---|---|

| Number of shares (stock) | Amounts calculated in balance sheets (thousands of JPY) | Number of shares (stock) | Amounts calculated in balance sheets (thousands of JPY) | |||

| IDEC Corporation | 55,000 | 55,000 | 104,940 | 141,790 | Because we are in a favorable ongoing business relationship with this company, we have determined that owning said company’s stock is necessary. | Applicable items |

| LECIP Holdings Corporation | 74,800 | 74,800 | 58,643 | 63,280 | Because we are in a favorable ongoing business relationship with this company, we have determined that owning said company’s stock is necessary. | Applicable items |

| Keisei Electric Railway Company, Ltd. | 19,177 | 18,788 | 77,093 | 61,437 | We have joined this company’s client stock ownership association. This company uses our products, and we have determined that it is necessary to own said company’s stock in order to maintain our relationship with them going forward. | None |

| Mebuki Financial Group, Inc. | 140,400 | 140,400 | 39,733 | 57,423 | We have determined that it is necessary to own stock in this company to facilitate smooth execution of financial transactions going forward. | Applicable items |

| Sumitomo Mitsui Trust Holdings, Inc. | 7,024 | 7,024 | 27,927 | 30,252 | We have determined that it is necessary to own stock in this company to facilitate smooth execution of financial transactions going forward. | Applicable items |

| Keihan Holdings Co., Ltd. | 6,742 | 6,552 | 31,385 | 21,491 | We have joined this company’s client stock ownership association. This company uses our products, and we have determined that it is necessary to own said company’s stock in order to maintain our relationship with them going forward. | None |

| The Hachijuni Bank, Ltd. | 35,000 | 35,000 | 16,065 | 19,950 | We have determined that it is necessary to own stock in this company to facilitate smooth execution of financial transactions going forward. | Applicable items |

| The Tokyu Corporation | 11,020 | 10,289 | 21,302 | 17,060 | We have joined this company’s client stock ownership association. This company uses our products, and we have determined that it is necessary to own said company’s stock in order to maintain our relationship with them going forward. | None |

| West Japan Railway Company | 1,000 | 1,000 | 8,339 | 7,431 | This company’s group sells automatic commuter ticket vending machines, etc., and we have determined that owning said company’s stock will also be necessary for our business strategy going forward. | None |

| Mizuho Financial Group, Inc. | 28,400 | 28,400 | 4,864 | 5,435 | We have determined that it is necessary to own stock in this company to facilitate smooth execution of financial transactions going forward. | Applicable items |

| Resona Holdings, Inc. | 1,000 | 1,000 | 479 | 562 | We have determined that it is necessary to own stock in this company to facilitate smooth execution of financial transactions going forward. | Applicable items |

(Annotations)

As it is difficult to describe the quantitative ownership effects of specific investment stocks, we have instead described methods for having verified the reasonableness of their ownership. We verify the purport of individual cross-held shares every quarter, and based on the results of the verification conducted as of March 31, 2019, we have confirmed that all cross-held shares we currently own are owned in conformance with our ownership policies.

No applicable items

(iv) Investment stock held for net investment purposes

No applicable items

(v) Investment stock for which ownership purpose was changed from net investment to other than net investment during this fiscal year

No applicable items

(vi) Investment stock for which ownership purpose was changed from other than net investment to net investment during this fiscal year.

No applicable items

7. Constant number of directors

The Articles of Incorporation for this company set its number of directors at 15 or fewer.

8. Requirements for decisions to appoint directors

When deciding to appoint directors, the Articles of Incorporation for this company stipulate that such decisions will be made by a majority vote of at least one third of shareholders capable of exercising voting rights in attendance at a general meeting of shareholders.

9. Matters decided by general meetings of shareholders that can be decided by the Board of Directors

(1) Interim dividends

In order to flexibly return profits to shareholders, the Articles of Incorporation of this company stipulate that interim dividends can be paid on September 30 every year per a resolution by the Board of Directors pursuant to the provisions of Article 454 Paragraph 5 of the Companies Act.

(2) Acquisition of own shares

In order to enable flexible execution of various management policies such as financial policy in response to changes in economic conditions, the Articles of Incorporation for this company stipulate that this company can acquire shares in itself through market transactions, etc., per a resolution by the Board of Directors pursuant to Article 165 Paragraph 2 of the Companies Act.

(3) Liability exemptions for directors and auditors

The Articles of Incorporation for this company stipulate that directors (including former directors) and auditors (including former auditors) can be exempted to the extent allowed by the law from liability for actions described in Article 423 Paragraph 1 of the Companies Act per a resolution by the Board of Directors pursuant to the provisions of Article 426 Paragraph 1 of said Act. This is to facilitate creation of an environment wherein directors and auditors can fulfill their expected roles to the best of their abilities when carrying out their duties.

10. Requirements for special resolutions at general meetings of shareholders

With respect to requirements for special resolutions at general meetings of shareholders as established by Article 309 Paragraph 2 of the Companies Act, the Articles of Incorporation for this company stipulate that such decisions will be made by a two thirds vote of at least one third of shareholders capable of exercising voting rights in attendance at a general meeting of shareholders. This is so that general meetings of shareholders can be smoothly managed by easing quorum requirements for special resolutions.

11. Details of auditor compensation, etc.

(1) Details of compensation for CPA auditors, etc.

| Subdivision | Previous accounting period of consolidation | Current accounting period of consolidation | ||

|---|---|---|---|---|

| Compensation for audit and attestation services (thousands of JPY) | Compensation for services other than audit and attestation services (thousands of JPY) | Compensation for audit and attestation services (thousands of JPY) | Compensation for services other than audit and attestation services (thousands of JPY) | |

| Submitting company | 34,270 | ― | 30,800 | ― |

| Consolidated subsidiary | ― | ― | ― | ― |

| Total | 34,270 | ― | 30,800 | ― |

(2) Other important compensation details

No applicable items

(3) Policies for establishing compensation for auditors

No applicable items

(4) Reasons why Board of Auditors assented to compensation, etc., for accounting auditors

Having confirmed the details of accounting plans by the accounting auditors, the state of execution of their duties, and rationale for the compensation estimates calculated, the Board of Auditors has determined that the compensation, etc., for accounting auditors is of a reasonable level, and has assented to said compensation, etc., pursuant to Article 399 Paragraphs 1 and 2 of the Companies Act.